Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

India and China are the two economic giants in the list of the fastest developing countries across the world with china ahead of India in diverse regards. China after its market reforms of 1978 started opening up its economy changing itself from centrally planned economy to market based economy, in similar ways India also opened up its economy after the reforms of 1990’s in the global market.

The history of the relationship between India and china has seen both ups and downs, both on political and economical grounds. Besides all these turbulence in the relationship between the two nations, China has never failed to remain one amongst India’s biggest trade partner with India being their biggest market place for their exports. This sturdy bilateral trade relationship is not only limited to the exports and imports, but also to so many other economic advantages that both the countries share for example this bilateral trade between both the countries has carved out the way for so many Indian enterprises setting up in China as joined ventures, representative offices, or as wholly owned foreign enterprises like Infosys, Wipro etc. to name a few, Similarly so many Chinese companies have also started setting up their operation in Indian land like Huawei technologies, Haier etc.

What will be the future of India and China relationship?

Why has the trade deficit of India with China remained high in past? Should India modulate its foreign trade policies with china?

These are certain question that depicts a domino effect when one starts pondering even on one such question.

In this bilateral relationship between India and China, India has always played the role of being the market base for the Chinese exports.

India’s trade deficit with China: The following table depicts the exports to China and imports from China of the Indian economy from 2009 to 2020 (Apr-Apr), value in US$ million.

| Year | Export to china ( In US$ million) | Import from China (In US$ million) | Share of export to China in total export. (In %) | Share of import from China in total import. (In %) | Trade deficit/surplus ( In US$ million) |

| 2009-2010 | 11,617.88 | 30,824.02 | 6.4995 | 10.6889 | -19,206.14 |

| 2010-2011 | 14,168.86 | 43,479.76 | 5.6717 | 11.7586 | -29,310.9 |

| 2011-2012 | 18,076.55 | 55,313.58 | 5.9081 | 11.3042 | -37,237.03 |

| 2012-2013 | 13,534.88 | 52,248.33 | 4.5056 | 10.6469 | -38,713.45 |

| 2013-2014 | 14,824.36 | 51,034.62 | 4.7150 | 11.3360 | -36,210.26 |

| 2014-2015 | 11,934.25 | 60,413.17 | 3.8456 | 13.4841 | -48,478.92 |

| 2015-2016 | 9011.36 | 61,707.95 | 3.4356 | 16.1960 | -52,696.59 |

| 2016-2017 | 10,171.89 | 61,283.03 | 3.6874 | 15.9443 | -51,111.14 |

| 2017-2018 | 13,333.53 | 76,380.70 | 4.3929 | 16.4055 | -63,047.17 |

| 2018-2019 | 16,749.59 | 70,319.55 | 5.0746 | 13.6799 | -53,569.96 |

| 2019-2020(Apr-Apr) | 1,442.28 | 5,318.10 | 5.5221 | 12.8462 | -3,875.82 |

Source: Ministry of Commerce and Industry

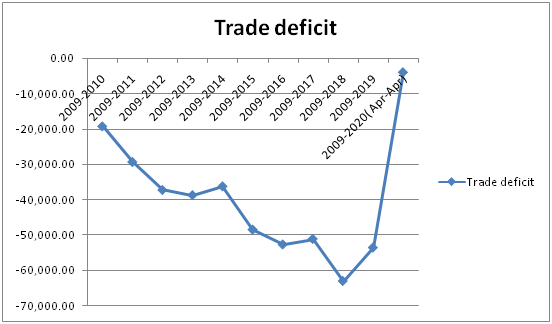

The table given up clearly indicates that India has a huge amount of trade deficit with China it becomes clear that the trade deficit has been growing between china and India since 2009 this pattern of consistent rise in the balance of trade between the two countries is visible till the year 2015-2016 after this, there is a fall in the trade deficit from -52,696.59 to -51,111.14 (In US$ million) in the period 2016-2017 and, again in the period of 2017-2018 there is rise in the balance of trade to -63,047.17( In US$ million). These are a considerable fall in the trade deficit with china after the period 2017-2018, as in 2018-2019 the balance of trade is -53,569.96. Similarly there is rise in the share of India’s total export to china from 2014-2015 to 2018-2019 from 3.8456% to 5.0746% respectively.

So what is the relationship between trade deficit and the foreign exchange rate ?

There exist a very interesting relationship between trade deficit of the country and the value of the currency of that country in the international market. Why is the trade deficit of any country high? There can be many answer to this question for example the trade deficit of the country is a situation when the imports are greater than the exports which can be due to a lot of reasons like inflation in the domestic economy of the country, trade policies of the trading countries to name a few. Taking the case of the inflation in the domestic market of the country, where there exist a situation like this the demand of imports from outside the domestic market increases, as outside the domestic market that is the markets of the foreign countries provide the same commodity for a cheaper price hence increasing the demand for imports.

How does it impact the foreign exchange rate? When there exists a market that is producing goods higher in price as compared to another country’s market. The demand for that country’s market product falls leading to a fall in the demand for the currency of the same country in the global market, hence depreciating the currency value. So there is a possibility of existence of an inverse relationship between the trade deficit and foreign exchange rate which states that higher the trade deficit, lower the value of the currency in the global market.(low value of currency over here is high rate of foreign exchange rate) assuming that other factors are kept constant.

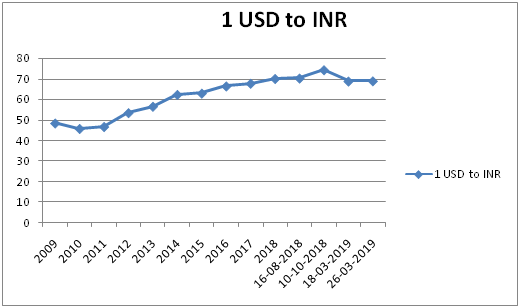

Tracing out the relationship between India’s trade deficit with china and its foreign exchange rate, following table depicts the value of one USD in terms of INR from the year 2009 to 2019

| Years | 1 USD to INR |

| 2009 | 48.41 |

| 2010 | 45.73 |

| 2011 | 46.67 |

| 2012 | 53.44 |

| 2013 | 56.57 |

| 2014 | 62.33 |

| 2015 | 62.97 |

| 2016 | 66.46 |

| 2017 | 67.79 |

| 2018 | 70.09 |

| 16-08-2018 | 70.30 |

| 10-10-2018 | 74.35 |

| 18-03-2019 | 68.85 |

| 26-03-2019 | 68.955 |

Diagrammatic representation of foreign exchange rate of India (2009-2019)

(X axis shows time period and y axis shows the value of 1 USD in INR))

Diagrammatic representation of balance of trade of India with china:

(X axis depicts time period and Y axis depicts trade deficit in US$ million)

The two graphs above clearly depict the relation between trade deficit and the foreign exchange rate of India and how they are interrelated; when the trade deficit of India with China was low there was a visible appreciation in the value of INR e.g. in the year 2018-2019 the trade deficit is -53,569.96 which is respectively lower than the year 2017-2018 that is -63,047.17 and corresponding to this the value of 1 USD to INR from 2018 onwards is also falling. And it is depicted that Indian rupees is getting appreciated in the money market.

How can India further reduce this trade deficit with china?

India thought of bridging this gap of deficit of trade with China with its proposal of trading with China in local currency that is Renminbi-Rupee. This proposal aimed at two very crucial aspect one was that to increase in the exports of India and second was to reduce the trade balance gap between India and China, but China has refused to accept this proposal, where as there were critiques of this proposal which stated that a country should not have trade deficit with the countries with which it aims at trading in its own local currency as it won’t be a level playing field for the party who is already having a large trade deficit.

India can benefit out from the trade war between United States and China, as after the United States came in the picture of the trade war with China, China as its retaliation against the states imposed 15% to 25% trade tariffs on the imports of the US goods were as it raised the tariffs by 5% to 10% for other countries. And according to the Asia-Pacific trade agreement (2015) Indian exports to China can further cherish the concession of 6% to 35% which will further strengthen the chance of exporting more of Indian goods and services to china, and because of the trade war between China and united states of America, India becomes a potential market for China from where it can imports goods, hence it can be an opportunity for India to stabilize its trade deficit with China. But since China and USA are the powers of today’s world they can easily manipulate world economic scenario against the favor of India,

Two sides of the story !

Impact of high trade deficit which further leads to a rise in the current account deficit can be seen both through the lens of positive results and negative results, it truly depends upon the discretionary will of the nation to choose between the one,

firstly trade deficit in certain countries are kept high in order to achieve certain trade goals, the dynamics for the same are: if the country trade deficit is high that means the county is importing more than its exports to the other nations and since the exports are lesser than imports the demand for the country’s currency falls in the global money market. Which further leads to depreciation in the value of the currency as the supply of the currency is greater than the demand, some countries keep their trade deficit high so that the value of their currency gets depreciated due to which their quantity of exports can be increased in the future.

Second face of the story narrates an entirely different notion in which the balance of trade comes into the picture, since the country’s trade deficit is high which leads to the rise in the current account deficit of the country, which the state balances with the help of capital account with the help of options such as borrowing which is further divided in two categories that are commercial borrowings or borrowing as external assistance, so in long run the country in order to balance out its current account deficit comes under the debt and also it has to pay the interest on the loans too, which becomes a liability for a country which to some extent can hinder the growth path of the country.

High time for India now it should strengthen its exports game.

Trade centuries back and now has not failed its position of being one of the most important indicators for the growth of the empires and the economies respectively, back then it was without the intricacies that are involved now but still it had its importance in deciding who holds the position of power across empires at epitome.

China, a country that is considered as the economic giant of Asia, holds this position due to its impeccable trade strategies. India also needs to strengthen its economy by stabilizing various variable that play crucial role in deciding the growth of the economy like balance of trade, foreign exchange rate etc. China has remained successful enough to increase its exports to India substantially since the 2000’s and from the report it becomes clear that India’s economy can be easily influenced by any change in the trade practices of China as it holds the average share of more that 10% in the total imports of India, where as India does not have this much share in the total imports by china, the average share of India’s export to china since 2009 has been 4.841645% only. Hence it becomes important for India to strengthen its exports game before it starts hindering the path of economic growth for India at its present as well as future.

References

Guha-Khasnobis, B., & Ranign, R. (1999). The Dynamics of the Real and Nominal Exchange Rates of India. Journal of Economic Integration, 14(1), 114-128. Retrieved from http://www.jstor.org/stable/23000473

(n.d.). Retrieved July 3, 2019E, from https://commerce-app.gov.in/eidb/default.asp

Sahu, D. (2018). Impact of bilateral trade between India and China. International Journal of Management, IT and Engineering,8(2). Retrieved July 5, 2019, from https://www.ijmra.us/project doc/2018/IJMIE_FEBRUARY2018/IJMRA-13360.pdf.

Ayyub, S. (2012). Indo-China relations: Present trends and future prospects. IIM Journal,1(2277-4211). Retrieved July 5, 2019, from https://mpra.ub.uni-muenchen.de/84156/1/MPRA_paper_84156.pdf.

Mohanty, S. K. (2014). India-China Bilateral Trade Relationship. Research and Information System for Developing Countries.Retrieved July 4, 2019, from http://ris.org.in/images/RIS_images/pdf/India china report.pdf

content/uploads/2018/11/India-China-Trade-Relationship_The-Trade-Giants-of-Past-Present India-China trade relationship(Rep.). (2018, January). Retrieved July 4, 2019, from PHD Research Bureau website: https://www.phdcci.in/wp–and-Future.pdf

(n.d.). Retrieved July 5, 2019, from https://commerce-app.gov.in/eidb/default.asp.

No local currency trade with India: China. (n.d.). The Hindu. Retrieved July 5, 2019, from https://www.thehindu.com/business/Economy/no-local-currency-trade-with-india-china/article25649134.ece

Kumar, S. (2019, July 05). Historical Data USD to INR from 1947 to 2019: 1 US Dollar Rate Chart. Retrieved from https://www.bookmyforex.com/blog/1-usd-to-inr-in-1947-2019/

How India can capitalize on US-China trade war. (n.d.). Economic Times. Retrieved July 3, 2019, from https://m.economictimes.com/news/economy/foreign-trade/how-india-can-capitalise-on-us-china-trade-war/articleshow/69528001.cms

NCRT. (n.d.). Retrieved July 3, 2019, from http://ncert.nic.in/ncerts/l/leec106.pdf

This is an example post, originally published as part of Blogging University. Enroll in one of our ten programs, and start your blog right.

You’re going to publish a post today. Don’t worry about how your blog looks. Don’t worry if you haven’t given it a name yet, or you’re feeling overwhelmed. Just click the “New Post” button, and tell us why you’re here.

Why do this?

The post can be short or long, a personal intro to your life or a bloggy mission statement, a manifesto for the future or a simple outline of your the types of things you hope to publish.

To help you get started, here are a few questions:

You’re not locked into any of this; one of the wonderful things about blogs is how they constantly evolve as we learn, grow, and interact with one another — but it’s good to know where and why you started, and articulating your goals may just give you a few other post ideas.

Can’t think how to get started? Just write the first thing that pops into your head. Anne Lamott, author of a book on writing we love, says that you need to give yourself permission to write a “crappy first draft”. Anne makes a great point — just start writing, and worry about editing it later.

When you’re ready to publish, give your post three to five tags that describe your blog’s focus — writing, photography, fiction, parenting, food, cars, movies, sports, whatever. These tags will help others who care about your topics find you in the Reader. Make sure one of the tags is “zerotohero,” so other new bloggers can find you, too.